Selling Puts (Options) can be used by a conservative investor to either buy stocks at a lower price or generate income during almost any market conditions. In this article I’ll talk about buying stocks at a lower price.

Summary

- As a conservative investor, you can get paid to buy your favorite stocks at lower prices.

- Using Apple stock as an example, the current price was $109.34/share, I wanted to buy it at $105/share, I made $116 in 2 weeks waiting for it to drop.

- In this case it did not drop to $105, so I got to keep the $116 and try again. If Apple would have dropped to $105 or less by my Expiration Date, I would still keep the $116, and my order would have been processed for 100 shares of Apple @ $105. My actual cost for the Apple stock would only be $103.84 ($105 less $1.16).

- This process is quite simple, it’s called “Selling a Put” option

- One Options Contract is 100 share of stock

Here is how it works:

Selling a Put – This pays you an immediate Premium ($$) for agreeing to buy shares at a future date (Expiration Date) at a specific price (Strike Price). You cannot lose the premium, you get it immediately posted to your cash account. The Put allow you to buy your favorite stock at a lower price and get paid until it hits your price. Selling a Put is also called “Writing a Put”.

Here is what a Put contract looks like in your account. This contract is AAPL 160408P105, it looks cryptic but it’s actually easy to understand. AAPL (the stock) 160408 (Expiration Date of 04/08/16), P105 (means a Put with a $105 Strike Price).

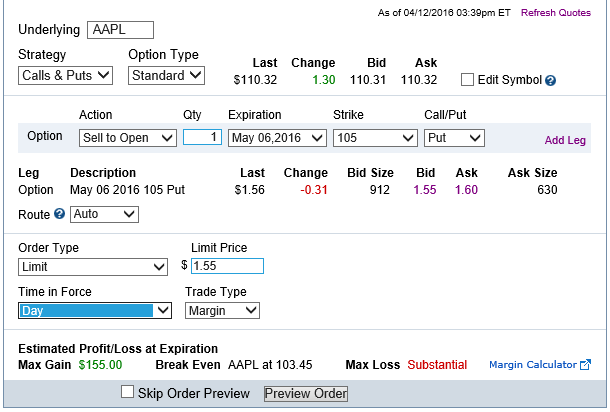

Here is what a Fidelity order entry screen looks like.

- The top portion shows the current stock price for Apple (AAPL).

- The Action is “Sell to Open”, this means you want to open an options position, by “selling”.

- Quantity is the number of Options contracts, keep in mind that an options contract is always 100 shares of a stock. 1 contract = 100 shares of Apple.

- Pick an Expiration Date, this is when the contract will expire, on these kind of trades I usually keep the date to 3 – 6 weeks.

- Strike (price) is the price you’d like to buy the stock at, in this case I’d like to buy 100 shares of Apple at $105/share, it was $110.32 at the time.

- Notice the Bid and the Ask Price. This is the amount of premium you will get, you’d like the highest amount you can get. I always use a Limit Order and wait for a decent price.

In my next post I’ll discuss how to use Selling Put’s as a way to make additional income, assuming you don’t want to actually own the stock, just collect the premium on each trade.