In my last post I explained how Selling Put’s can be used by the conservative investor to buy stocks at a lower price during almost any market conditions. You can read that story to better understand how Selling a Put works.

In this article I’ll talk about how to either make a living or supplement your income by Selling Put’s for a profit.

Summary

- In this case we want to Sell Put’s on stocks what we just want to collect the premium on, and not necessarily want to own the stocks.

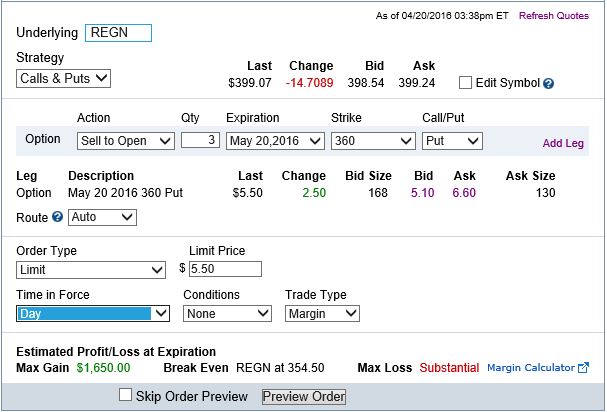

- Using Regeneron (REGN) stock as an example, the current price today April 20th is $400/share.

- I’m looking at the May 20th $360 Put’s, paying a premium of $5.50 per contract (100 shares).

- Therefore, if I Sell these Put’s I get $550 immediately in my account per contract. I am looking for the price of REGN to be at or above $360 by the May 20th Expiration Date. This is roughly 10% below the current selling price.

- If the price of REGN is below $360 on May 20th I must either buy the stock, or just buy out of my Put position. My favorite web site shows that this trade has an 81% chance of “expiring” which I want it to do, and my return is 1.42% for 30 days or 17.24% annualized.

- As a sanity check I check out the REGN stock chart and see that the lowest price in the last 12 months has been about $359 and the stock has bounced off its bottom and is above its 50 EMA.

- This might be within your risk tolerance.

Here is what a Put contract looks like in your account. This contract is REGN 160520P360, it looks cryptic but it’s actually easy to understand. REGN (the stock) 160520(Expiration Date of 05/20/16), P360 (means a Put with a $360 Strike Price).

Here is what a Fidelity order entry screen looks like for a 3 contract transaction.

Here is what the REGN stock price chart looks like, notice the move above the 50 EMA live, a positive sign.

I always double check my Put Options trades with my favorite Options site: www.stockoptionschannel.com , here is what it said. This trade has an 81% chance of “expiring” worthless, which I want it to do, and my return is 1.42% for 30 days or 17.24% annualized.

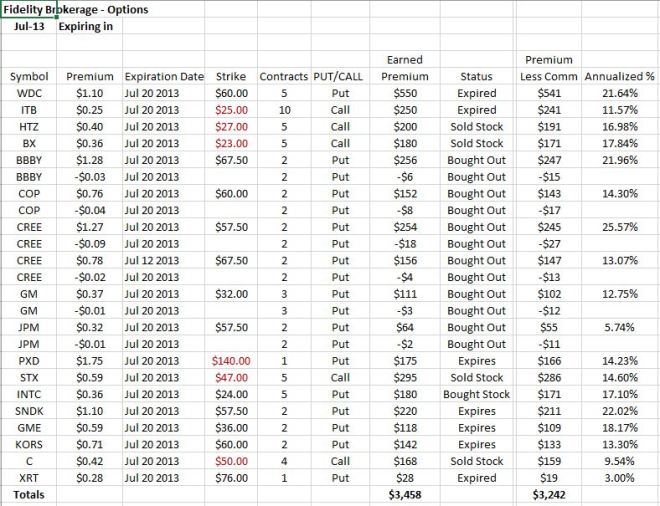

So can you make money doing this, yes, once you understand it and manage your risk. Here is a copy of my monthly Options Trading spreadsheet for July 2013. You can decide how much risk/reward you are willing to take.

You’ll notice that the above sheet also shows some Call Options, I’ll explain these in a future article.

Hello

I am trying to learn this. Above statement needed how much capital if you can help.

2nd in today’s market conditions where correction is around the corner what is advise.

3rd if I wanted to replace $10000.00 monthly income how much capital I would need.

Please help.

Thank You

LikeLike