Why do you invest … hopefully to make money.

Why money … well it can help you achieve goals in life and provide you with a sense of security and freedom.

What makes some investors better than others? Sometimes it just to have a better plan.

Here is my list of “Commandments” to help you achieve your goals.

- Understand your motivation, it will change with age! Freedom, Security …. Fear?

- Have a 4-bucket strategy, Taxable, IRA/410K, Roth, bank account. Put everything in the right bucket. Beware of sitting on too much cash.

- Justify every investment is it a trade, investment or cash generator?

- Let the winner run, until they aren’t winners! Taking money off the table …. why?

- If you don’t understand it, don’t buy it! People put Muni bonds in an IRA, or buy annuities …..

- “They” say you need to rebalance? Sell the winners … in a taxable account, why?

- Stay out of China, EM and foreign stocks, S&P is already diversified, 40% revenue outside US. Same with Penny stocks, gold, crypto, “value” and “small cap”

- When in doubt just buy 50/50 S&P 500, NASDAQ 100

- Don’t fund your company 401K beyond the company match

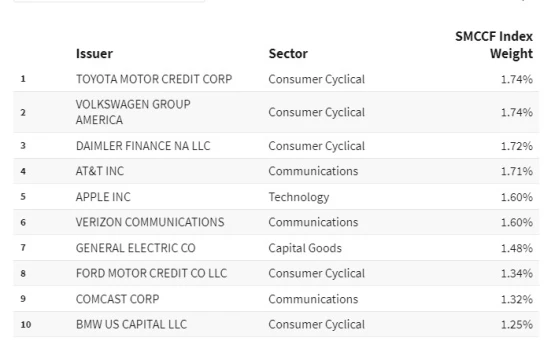

- Bond funds lose out to actual bonds. Beware of bonds in a taxable acct, tax issues

- Understand the Rule of 72 and the difference in price vs cash return

- Be tax smart, all the time. Give or gift kids/church/charity money, make it your most highly appreciated stock, NOT cash! Charitable/church count towards your RMD!

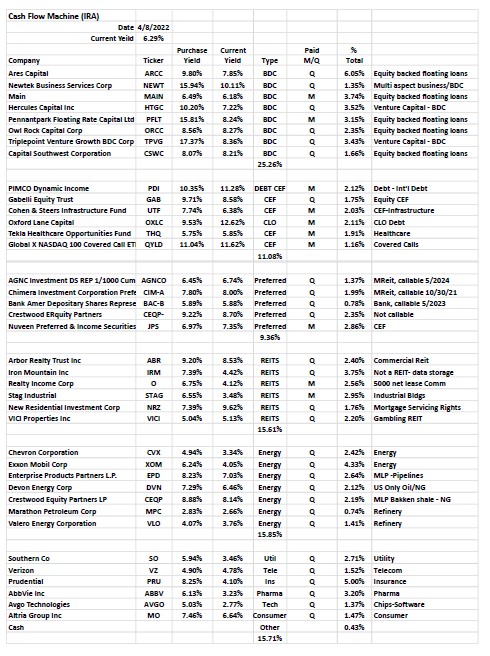

- Beware of “standards” like 60/40 , 70/30 etc. Bonds can be “bond surrogates” too.

- IRA & 401K’s are great, UNTIL you need them, huge tax issue!

- Best places for your next dollar of investment, in this order- Roth, taxable, 401K/IRA

- In our lifetime, large cap tech stocks, selective chip stocks are a must own. Don’t fight momentum

- If you have substantial assets you need a Trust to front-end your will.

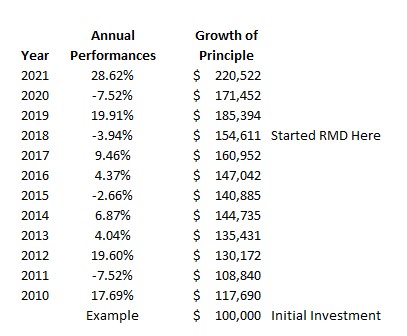

- Over the last 28 years Target Dated Funds have been a failed experiment, grossly underperformed markets including 60/40 portfolio’s. It’s reported that approx 40% of company sponsored 401k plans are now Target Dated.