At our community Investment Club meeting last week a member asked for a description for how DRIP programs work for dividends. Answers were provided and I thought this would be a good topic to write on since there are some misconceptions.

If you are an investor you should understand what a DRIP is, an automatic “dividend reinvestment plan”. Let’s take a look at your choices in dealing with stocks, ETF’s or mutual funds when it comes to dividends.

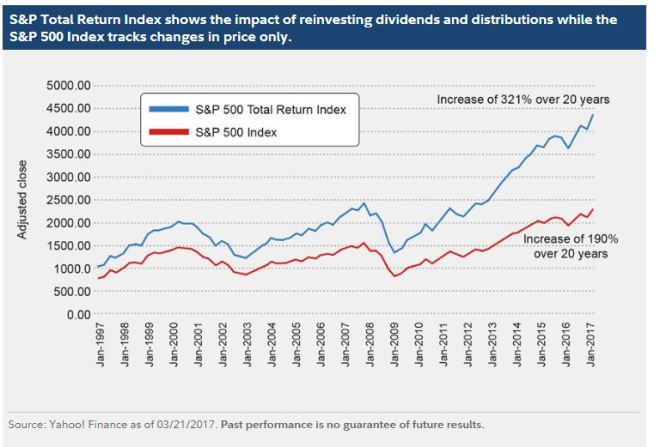

Dividends offer long term investors with the opportunity to improve their total returns over time. How important are dividends, check out this chart showing “returns” from 1997 to 2017, for the S&P 500 index.

When dividends of the S&P 500 were reinvested back into the index the power of compounding took over and increased the total return from 190% to 321% over 20 years.

A DRIP (dividend reinvestment plan) will allow you to automatically have your brokerage provide you with new shares of stock, instead of a cash dividend deposited into your cash account.

Let’s look at a simple example of how this works. Let’s say you have a stock with a current price of $40/share and this quarter you get $150 in dividends. Most of the time, the amount you receive as a dividend won’t divide evenly to buy only whole shares with nothing left over. Therefore your dividend reinvested will buy 3.75 shares. The brokerage adjusts the number of shares you own in whole numbers and shows a 0.75 fractional share. At the next dividend date, if the same thing happens you will be credited with another 0.75 share. It will look a little strange to see that you own 103.75 shares of Apple, but your broker will handle all of this.

Now, behind the scenes it isn’t your broker doing all of the work, in fact the company/fund/ETF you own shares of must have a DRIP program in the first place. Most do. Your brokerage just makes it easy for you to participate, most not charging any fees or sales commissions on the new shares.

How difficult is it to set up a DRIP for your stocks, funds or ETF’s, it should be very simple. Here is an example on my Fidelity account:

In Fidelity just go to Accounts/Trade – Account Features – Brokerage & Trading – Dividend and Capital Gains. This will show you, by each account which stocks are eligible for DRIP’s.

After selecting a stock, just choose “Reinvest in Security” and choose Update. As you can see in the above example, on NXP stock I have DRIP turned off, therefore all dividends are just deposited into my cash account.

I noticed that the majority of my dividend stocks and ETF’s had DRIP capabilities. I also noticed that none of my preferred stocks allowed it and a few BDC’s did not allow it either.

Benefits of DRIP’s:

- It helps buy more shares of an investment.

- Compounding dividends may help you reach your investing goals.

- Your brokerage house will track your “costs basis” on all new shares for determining tax treatment (in a taxable account) when you sell any shares.

- Most brokerage houses, like Fidelity do not charge any fees or commissions on this transaction. If you have a lot of dividend stocks, over a period of time this is a substantial costs savings.

- Company’s save cash by providing dividends as shares of stock.

Why You Might Not Want To DRIP:

- By using DRIP you give up the ability to reinvest dividends in another stock or fund, for example you may already have a full allocation in Apple and want to use the dividends to buy something else.

- You may need the cash, for example in your IRA you’ll want to maintain a cash balance to handle your RMD (required minimum distribution) withdrawals.

Tax’s:

There is no free ride on dividends held in a taxable account. When dividends are awarded to you, whether in cash or as additional shares you will owe taxes on them. If you are sensitive to paying taxes on dividends and capital gains for mutual funds in a taxable account you may want to consider receiving your dividends in cash and reinvesting yourself into a more tax friendly investment. For example, a mutual fund or ETF may provide a high percentage of its dividends as regular dividends (not Qualified Dividends), these regular dividends are taxed at your ordinary income level, vs. the special rate for “qualified dividends”.

In any case a conservative investor may want to hold a sizable portion of their portfolio in dividend generating stocks and reinvesting the distributions to enhance the Total Return.