Concept for good investment and money making

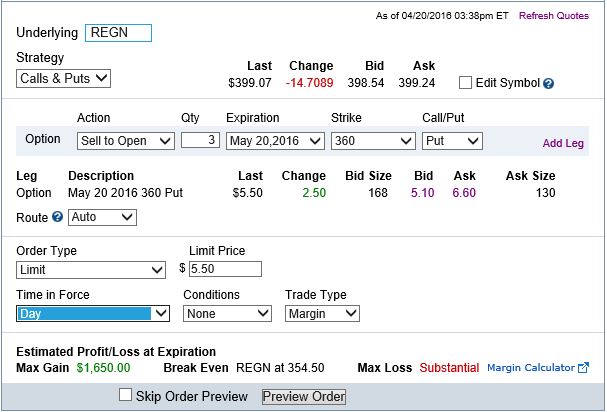

In my last posts I explained how Selling Put’s can be used by the conservative investor to buy stocks at a lower price, or how to make an income selling them on a regular basis. See the articles here and here.

In this article I’ll talk about how a very similar process, Selling a Covered Call on your existing stocks to enhance your income. It’s called “Covered” because you already own the stock in your account.

Summary

- When you “Sell a Covered Call” you give someone the right to buy your existing stock at a certain price (Strike Price), while collecting an immediate cash premium.

- Conservative investors use this trade to enhance their income on stocks they already own, like getting an extra monthly dividend.

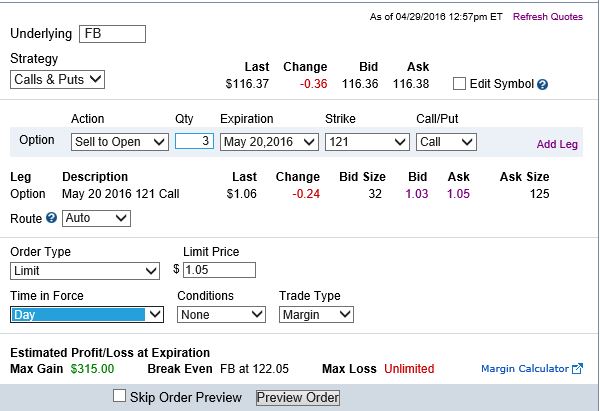

- Using Facebook (FB) stock as an example. I already own Facebook in my account, it has been a great performer. Today April 29th Facebook is trading at $116.50/share, after a recent jump in price.

- I’m looking at the May 20th $121 Call Option, it pay me a premium of $1.07 per contract (100 shares).

- Therefore, if I Sell these Call’s I get $107 immediately in my account per contract. I am looking for the price of FB to be below $121 by the May 20th , the Expiration Date.

- If the price of FB is at or above $1210 on May 20th I must either sell my stock, or just buy out of my Call position.

- Another way to look at this is if my shares get “Called Away”, I will get $5.57/share in profit. $1.07 was the Call Option Premium, plus $4.50 from the price increase from $116.50 to $121 per share. That is a 4.8% return in 30 days or about 57% annualized.

- My favorite web site shows that this trade has an 73% chance of “expiring” which I want it to do, and my return is .91% for 30 days or 15.81% annualized.

- As a sanity check I check out the FB stock chart and see that the stock is trading at about an all-time high after a recent increase.

- This might be a nice safe little trade.

Here is what a Call contract looks like in your account. This contract is FB 160520C121, it looks cryptic but it’s actually easy to understand. FB (the stock) 160520(Expiration Date of 05/20/16), C121 (means a Call with a $121 Strike Price).

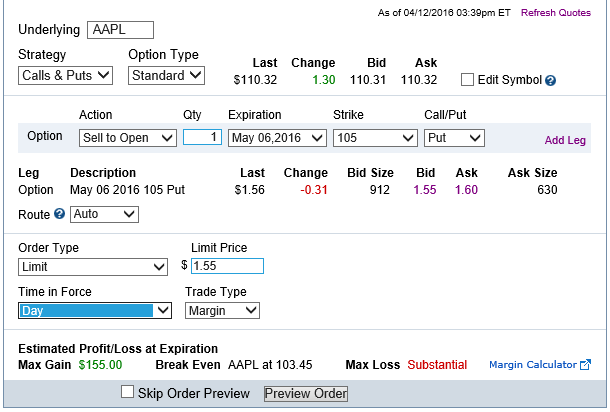

Here is what a Fidelity order entry screen looks like for a 3 contract transaction.

I always double check my Call Options trades with my favorite Options site: http://www.stockoptionschannel.com , here is what it said.

Here is what Facebook’s stock chart looks like:

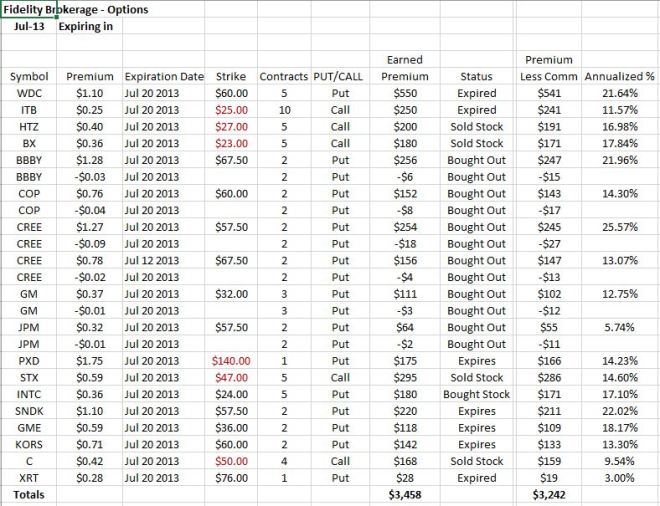

So, can you make money doing this, yes, once you understand it. Here is a copy of my monthly Options Trading spreadsheet for July 2013. You can decide how much risk/reward you are willing to take. Look at the Call Options.

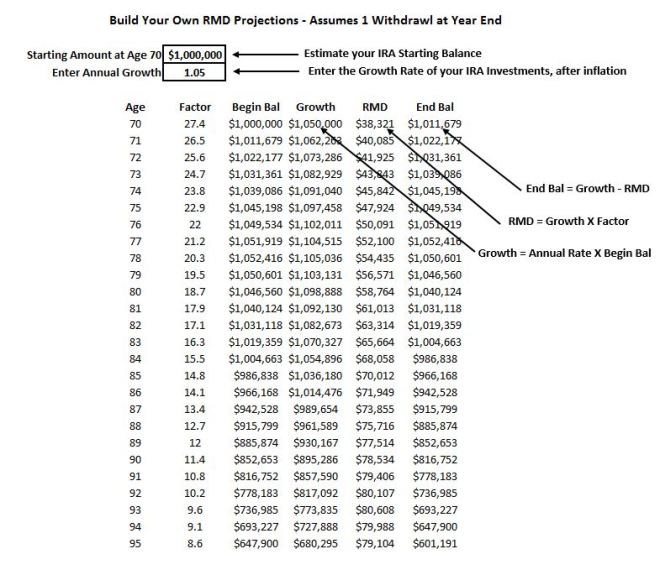

We are all faced with the dilemma of taking Required Minimum Distribution from our IRA accounts when we turn 70 years old. If you have accumulated large IRA’s (including transferred 401K accounts), this can be a problem.

We are all faced with the dilemma of taking Required Minimum Distribution from our IRA accounts when we turn 70 years old. If you have accumulated large IRA’s (including transferred 401K accounts), this can be a problem.